Last weekend in the Financial Review, Andrew Clark began his article (on page 52) with the words:

“Australians don’t know if they’re in the middle of a pause that refreshes or the dullness before the deluge.”

That about sums up the general feedback I am receiving at the moment, from clients and colleagues alike.

Clark felt this probably stems from a combination of …

- a lack of Federal leadership,

- declining retail turnover,

- poor flow-on from the mining boom and

- the spectre of financial defaults overseas.

Presumably, this was behind the RBA’s decision to keep the cash rate on hold until next month — pending more economic data in the coming weeks.

On the plus side …

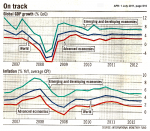

According to the IMF … in spite of all the recent turmoil, the outlook for global economic growth appears quite rosy moving into the new financial year.

According to the IMF … in spite of all the recent turmoil, the outlook for global economic growth appears quite rosy moving into the new financial year.

You will have noticed that both food and oil prices have started to settle down; and the expected demise of China did not eventuate — after launching its severe assault on inflation.

Plus, Japan is now on the path to recovery following its two horrific natural disasters. In fact, Japan’s industrial production surged by 5.7% in May, as its massive reconstruction program begins to restore economic activity.

Does Australia really need to choose?

Some pundits believe we will soon need to choose in our economic alliance … between China and America. However, most people do not realise just how intertwined our relationship with these two countries actually is.

It is Chevron (the US energy giant) who is currently pouring millions of dollars into extracting natural gas from our North-West Shelf. And this is because Chevron finds it far cheaper to ship the LNG from here to China … than it does all the way from Qatar.

As such, this could soon make Australia the world’s largest exporter of LNG — with China as its prime market.

Bottom Line: Rather than being fearful of the future … Australians need to understand and embrace the strategic position we find ourselves in.

As I’ve mentioned before in relation to Commercial property … whenever people are confused, they tend to do nothing!

But once overseas economies begin to pick up as the IMF predicts … Australia will quickly enjoy reaping the benefits.

Therefore, now is the time to grasp the opportunity; and position yourself to ride the surge in Commercial property values through to 2018.

Speak Your Mind