My apologies for not posting any articles for the past week or so … but I sneaked away to Noosa with Jenny for a short break.

Anyway, I’ll make it up to you with two articles for this week.

Firstly, about Retail …

You’ve been aware of my general concern with the Retail sector over the past few years. And that’s because the fundamentals are out of alignment.

You’ve been aware of my general concern with the Retail sector over the past few years. And that’s because the fundamentals are out of alignment.

Of all the sectors within the Commercial market, most people feel comfortable with Retail. And that’s only natural — because all your family members are usually going in out of shops, as part of their everyday life.

However, familiarity with something doesn’t always make for good investment decisions.

And yet, investors continue to out-bid one another — quite prepared to accept yields as low as 3% per annum, for some Retail investment properties.

Inherent in such as decision is the belief there will be a significant rental increase not too far away.

Inherent in such as decision is the belief there will be a significant rental increase not too far away.

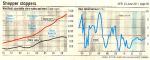

But as you can see from these graphs, Store Rent has been outstripping Store Sales for quite a while. And Turnover is unlikely to reach its long-term growth level 4% any time soon.

That means a significant re-adjustment is about to take place within the Retail sector.

And there are two structural changes driving this inevitable change:

- Australians were net spenders in 2005; but we now have an historically high 11.5% savings rate.

- Traditional retailers shot themselves in the foot by highlighting the presence of online shopping. Currently at 6% … Westfield Group are predicting this will reach 10% of sales, over the next five years.

Bottom Line: Not all Retail properties are at risk — because it all comes down to your tenant.

Food and hardware outlets near new housing estates (for example) will be in high demand. As will traders who have wholesale or corporate clients, in addition to their in-store traffic.

However, if you currently hold retail property with specialty tenants (like fashion or gifts) … now would be a good time to rationalise your portfolio.

Speak Your Mind