AS YOU CAN IMAGINE, this is a question I often get asked.

So, let me perhaps start by saying that with all my properties … I, personally, engage a skilled property manager.

And people then ask … If you know so much about commercial property, why don’t you manage the properties yourself?

The answer’s fairly straightforward – as there are basically 4 reasons … [Read more…]

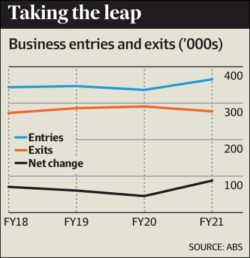

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.