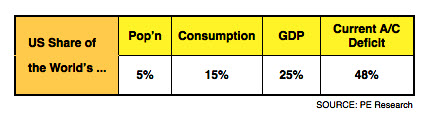

It’s not just rising interest rates that the Rudd government will have to contend with, in the run-up to the next election.

The joy of the resources boom restarting brings with it certain unwanted side effects. What you will start to see is wage rate increases; plus the drawing away of materials and equipment, from other sectors within our economy.

Furthermore, the stronger Australian dollar will bring increased hardship to our tourism and manufacturing industries — who exported goods and services internationally.

Not to mention, our local businesses … who are finding it harder and harder to compete with cheaper imports.

Clearly, Australia doesn’t want to miss out on the extraordinary growth occurring in both China and India.However, the real test of the government will be in how it oversees the insatiable demand for labour and capital by the mining sector — while not starving the rest of the economy of these same key business imports.

With the voice of trade unions becoming louder, the temptation for Rudd is to resort to government subsidies. But sadly, it is often the most vocal (rather than the most deserving) who seemed to benefit from these type of handouts.

Maybe the preferred option would be to allow the “fittest” to survive; and thereby cause of Australia’s overall productivity to rise in the process?

But then, it is an election year!

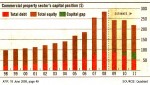

Nonetheless, the continued stronger demand bodes well for Commercial property during 2010 and beyond.