BEFORE THE PANDEMIC, there was a shortage of office space looming within the Sydney and Melbourne CBDs.

In fact, both were heading towards unhealthy vacancy levels of around 2% to 3%.

However, with extended lockdowns and some new supply coming onto the market … all that has clearly changed. [Read more…]

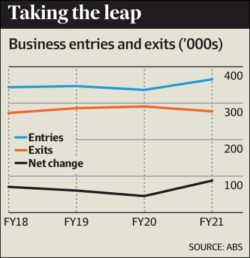

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.

Apparently, there were 365,500 new start-ups along with 277,700 established businesses closing shop – delivering a net gain of 87,800 new businesses.