LAST TUESDAY, you gained some insights into the changing Retail scene, for Commercial property around Australia.

According to some recent research by JLL & CBRE (BusinessDay: 29 Feb 2012), these trends are clearly starting to emerge within the Melbourne CBD.

According to some recent research by JLL & CBRE (BusinessDay: 29 Feb 2012), these trends are clearly starting to emerge within the Melbourne CBD.

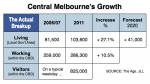

The current vacancy rate is hovering at around 1%. And in part, this is due to the Growing number of people living and working within central Melbourne.

However, part of the reason behind this also lies in the recent entry into the market of several major overseas retailers. [Read more…]

And you do this by creatively targeting investors, developers and potential owner-occupiers — through adopting a broad (yet cost-effective) marketing campaign, which draws out those buyers best suited to your property.

And you do this by creatively targeting investors, developers and potential owner-occupiers — through adopting a broad (yet cost-effective) marketing campaign, which draws out those buyers best suited to your property.

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market.

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market. The underlying fundamentals for Australia are strong.

The underlying fundamentals for Australia are strong.