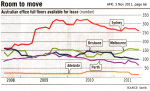

EVERY capital city has both a CBD and suburban Office market. And as you can appreciate, keeping tabs on all the various suburban markets is almost an impossible task for most investors.

But generally speaking, the health (or otherwise) of the CBD Office markets within each capital city will provide you with a fairly good gauge of the overall Office scene around Australia.

But generally speaking, the health (or otherwise) of the CBD Office markets within each capital city will provide you with a fairly good gauge of the overall Office scene around Australia.

Accordingly, this graph will provide you with a clear picture of what has occurred over the past 4 years.

As a rule of thumb, Office markets are said to the “in balance”, when their Vacancy Rate lies between 5% and 7%. [Read more…]

The banks seemed to be protesting about the increased cost of offshore borrowing. And using that as their excuse for not wanting to pass on any future RBA rate reductions in full.

The banks seemed to be protesting about the increased cost of offshore borrowing. And using that as their excuse for not wanting to pass on any future RBA rate reductions in full.

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market.

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market. The underlying fundamentals for Australia are strong.

The underlying fundamentals for Australia are strong.

Many investors just simply fall in love with Retail property. And probably, because of familiarity — as it tends to influence so much of our daily lives.

Many investors just simply fall in love with Retail property. And probably, because of familiarity — as it tends to influence so much of our daily lives.