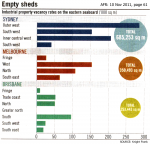

The Queensland economy may be slow to recover from all its natural disasters. But it’s Industrial property sector has been quick out of the blocks.

The Queensland economy may be slow to recover from all its natural disasters. But it’s Industrial property sector has been quick out of the blocks.

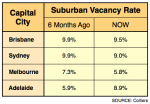

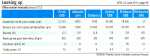

The boom in Queensland gas now has Brisbane with the lowest vacancy rate for Industrial property.

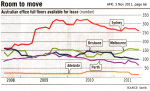

Next comes Melbourne — with Sydney well back in 3rd place, according to a recent survey by Knight Frank.

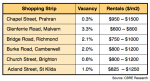

And increasing demand will put further upwards pressure on rentals … thereby, encouraging more developers into the market. [Read more…]

You’ve been aware of my general concern with the Retail sector over the past few years. And that’s because the fundamentals are out of alignment.

You’ve been aware of my general concern with the Retail sector over the past few years. And that’s because the fundamentals are out of alignment.