THE NEAR-ZERO Office vacancy rates enjoyed by the mining cities of Brisbane and Perth pre-GFC … now seem to have come back into line with the other capital Cities.

THE NEAR-ZERO Office vacancy rates enjoyed by the mining cities of Brisbane and Perth pre-GFC … now seem to have come back into line with the other capital Cities.

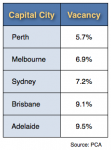

The latest survey released by the Property Council of Australia (PCA) displays a much more even spread for Offces vacancies around the country.

The cooling of the mining sector, coupled with the Queensland floods, has caused a number of key players to rethink their Office space requirements.

So, what’s happening around Australia?

In the past 6 months, Perth‘s vacancy rate has increased by nearly a quarter — to where it now sits at around 5.7%. This has followed some major staff and space reductions, by the mining companies and their related consulting firms.

In the past 6 months, Perth‘s vacancy rate has increased by nearly a quarter — to where it now sits at around 5.7%. This has followed some major staff and space reductions, by the mining companies and their related consulting firms.

Over the past 5 years, developers in Melbourne have had the chance to secure pre-commitments from major tenants wishing to move into brand-new buildings within Docklands. And only recently has it become viable to tackle any new projects within the CBD proper.

Therefore, most of Melbourne’s increased vacancy (currently at a respectable 6.9%) has resulted from the need to refurbish and back-fill the space being vacated.

The past 6 months has actually seen Sydney‘s vacancy rate fall to 7.2%. However, the leasing market remains cautious — because much of the available space was withdrawn … as landlords look to refurbish the buildings, before re-offering them to the market.

As such, around 165,000 sq metres of space is due to come onto the market over the next 12 months — representing about 3 years supply.

Mining companies led the Office boom in Brisbane; a but that demand has sadly fallen away. And now that impact is being felt, as the current vacancy rate of 9.1% needs to be mopped up by traditional businesses. And like Sydney, there is also a number of major projects due for completion over the next 3 years.

With a vacancy rate of 9.5%, Adelaide currently sits as the highest for any mainland capital city. But unfortunately, things are likely to get worse.

With the completion of several major projects, the PCA estimates the past 6 months has produced Adelaide’s 4th highest supply increase on record — being 3 times its historical average.

As such, the current vacancy rate will no doubt rise … before returning to a more reasonable level, of around 7% to 8%.

Bottom Line: The Commercial property playing field around Australia now seems considerably more level.

While access to CBD Offices may not be readily available for the small to medium investor, this sector does provide a good guide to the health of the overall Office market.

Clearly, interest rates and consumer confidence (ie: spending levels) dramatically affect Retail property. And to a lesser extent, industrial property — which (in Australia) caters mainly to warehousing for retailers.

However, according to an 80-year study by Macquarie Bank, there is apparently NO correlation with rising interest rates having a detrimental affect upon Office property.

And so, given we are currently at the bottom of the interest rate cycle … that ought give you considerable added confidence for investing in the Office sector going forward.

Speak Your Mind