WHILE EVERYONE seems to agree that the residential market is currently moving sideways, investors often find it difficult to gauge how direct investment into Commercial property is really travelling.

WHILE EVERYONE seems to agree that the residential market is currently moving sideways, investors often find it difficult to gauge how direct investment into Commercial property is really travelling.

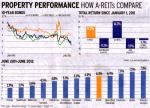

However, perhaps the best gauge is to take a look at what the share market thinks about A-REITs (Australian Real Estate Investment Trusts).

Generally, these yields tend to operate at about 1.5% to 2% below direct investment into property. Nonetheless, they can be a great indicator of where the present trend is heading.

With debt now under control, the A-REITs have put in a solid performance over the 12 months to June this year.

As you can see from the charts, this trend has been consistently upwards when compared to:

- 10-year bonds;

- the RBA cash rate; and

- most other types of equities.

In fact, since January 2011, A-REITs have returned 11.2% in total; as opposed to equities, at -9.3%.

Looking forward

With consolidations, the number of A-REITs has dropped from 24 to 19. And investors also have the comfort of knowing, they are buying at a discount to current asset backing.

Those A-REITs focusing primarily upon Office and Industrial property would appear to be performing the best. And that is consistent with what you’re currently seeing with direct investment into Commercial property.

Bottom Line: As you’re probably aware, the share market tends to price in forward trends — generally giving you a 6-month lead-time, on what is likely to occur.

As such, you now have yet another source confirming the underlying strength of the Commercial property market — which should give you some added comfort to secure a property now, in your own right.

Speak Your Mind