AS YOU PROBABLY realise, this is not quite as simple as it may seem. And yet, all you need to do is follow some clearly defined procedures.

And here are some more details …

In a recent Financial Review article, Terry White (pharmacist) covered the benefits he gained from using his Personal Super Fund to purchase the Commercial properties now occupied by his retail outlets.

Naturally, you will need to obtain your own independent advice … but we have included a quick overview of the basic details below.

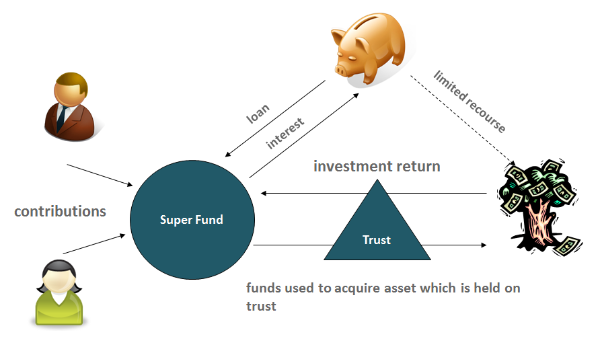

.The main condition to be met is that any loan has to be limited recourse — where unlike a normal mortgage, the lender has no claim against any other assets of your Fund, if there is a default.

Furthermore, the property itself needs to be placed in the name of a “holding” trustee — which has to be different from the Fund’s ordinary trustee, who are typically the members of the Fund..

Hopefully this flow-chart gives you a clearer picture of how it all works.

Bottom Line: Here are some of the Benefits you can expect.

- Fast-track your wealth build-up — by leveraging cash for investment.

- Property provides diversity for your SMSF investments.

- Rental income can be used to help in repay the loan.

- Your Fund can enjoy the benefits of Negative gearing.

- Your Fund pays concessional Income Tax on the net income.

- Limited recourse borrowing safeguards the other assets in your Fund.

- CGT is at only 10%, provided the property is held for at least 12 months.

- You are able to lease the property to your family business.

These Borrowing Structure Details have been provided by CIA Tax, who specialise in helping investors package up acquisitions like this, for your SMSF. And so, we suggest you give them a call on (03) 9553 1210 … to discuss exactly how it would work for you...