The RBA’s decision on interest rates yesterday came about because of what’s happening here in Australia, rather than in Europe.

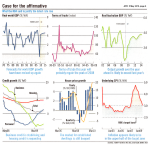

It has been made against the backdrop of our exporters having recently extracted massive price hikes for iron or in coal, as a result of China’s strong growth.

This has more or less offset the rise in Australia’s local retail prices, through a sharp decline in the cost of imported items — like electrical goods, clothing, footwear and furniture.Since the global turmoil started in 2008, the $A has climbed by nearly 55% against the $US — and just over 40% against our other key trading partners.

As a result, the NAB’s business confidence index stands firmly positive for the third consecutive quarter. And even more importantly, actually improved throughout the last quarter.

h2. How will this affect Commercial Property?

As company inventories shrink and profits climb, businesses across the board are now looking to employ more people — which will cause many of them to seek new premises. Something they have put on hold, over the past year or so.

Already Office leasing enquiry has picked up significantly during 2010. And you’ll now start to see solid rental increases flow to Commercial investors through to 2014.

Melbourne, Sydney and Adelaide have very little current construction going on — therefore, vacancy levels will quickly tighten heading into 2011.

Brisbane, Canberra and Perth still have significant projects nearing completion. And so, their vacancy rates will continue to climb the next few years.

Speak Your Mind