MOST PROPERTY investors also run their own business. And as such, you realise there are significant costs involved in starting any new venture.

There are expenses for equipment, stock, insurance, staff overheads and (if you don’t own the building) funds required to cover rent.

Whether you own or rent the building, there may also be costs involved in fitting out the new space to make it appropriate to open the doors for business.

While it can be daunting to outlay substantial money to fit out a new business, there are ways owners of new businesses can reduce the costs involved.

One of the ways investors can save on any costs involved in installing fit out is by ensuring to take advantage of the depreciation deductions available for these items.

It’s important to know what you can claim

Commercial property owners and their tenants are entitled to claim depreciation deductions.

Owners can claim capital works deductions for the wear and tear, which occurs to the building structure. Plus, depreciation deductions for any existing plant and equipment assets they own; or the fit out they add to the building.

Simultaneously, tenants are entitled to claim depreciation deductions for any of the fit out they add after commencing their lease.

Given that both parties can claim deductions at the same time, it is important that both owners and tenants contact a specialist Quantity Surveyor to each request a depreciation schedule.

To complete a depreciation schedule, the Quantity Surveyor will perform a site inspection to take detailed notes and measurements and to photograph any of the assets they find in the building.

Each schedule will provide a detailed list of the items found and the deductions the owner or tenant can claim, when they visit their Accountant to complete their income tax assessment.

A Case Study

To demonstrate the difference that claiming depreciation deductions can make for a new business owner, let’s take a look at an example.

The business owner rented a space and installed a range of fixtures and fittings to convert the building into something appropriate for a small clothing store.

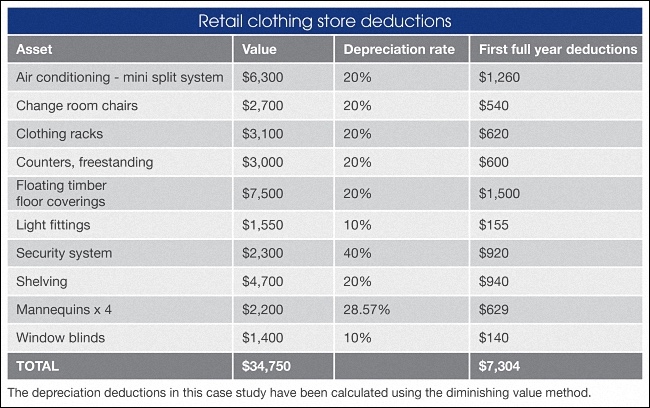

The following table outlines the details of the assets they installed, their value and the first full financial year deductions discovered by the specialist Quantity Surveyor.

As this example shows, while the owner spent $34,750 on the fit out of their new business, they will be able to recover quite a significant portion of the expenses involved by claiming depreciation.

In the first full financial year alone the retail clothing store owner can claim $7,304 in depreciation deductions from items installed in this fit out.

Bottom Line: Essentially these deductions will allow the owner to reduce their income tax payable, which can improve the owners cash flow should they receive a tax refund depending on other income earned.

Speak Your Mind