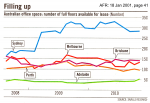

IF WORKING FROM HOME is so appealing, why are businesses and governments choosing to hold onto their office space – and in many cases, lease even more?

According to the Property Council of Australia, Melbourne’s CBD towers were only 12% occupied in December – but 88% leased. And Sydney’s CBD towers were 23% occupied, but 91% leased. [Read more…]

Wherever you live, you tend to believe (and will happily tell people) that it is undoubtedly the

Wherever you live, you tend to believe (and will happily tell people) that it is undoubtedly the