Relax, it hasn’t all come to an end.

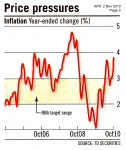

Sure, the Australian economy may have grown by only 0.2% in the September quarter. And retail sales might have actually fallen by 1.1% for October.

However, the overwhelming consensus is that this is merely an aberration.

And the underlying growth projections remain very favourable — with the full effect of the mining boom having resumed, due to be felt by mid-2011.

[Read more…]