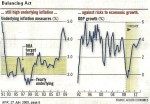

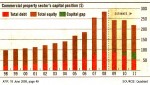

As you would expect, the financial turmoil worldwide has had a significant effect on most property markets. However, the effect has not been the same across the board.

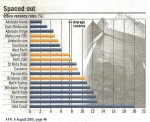

The current state of the various CBD office markets is probably your best barometer of future activity for two reasons. First, the Property Council of Australia (PCA) conducts six-monthly surveys to establish the CBD vacancy rates right around Australia.

[Read more…]