WHENEVER you find yourself with Power during a negotiation, you are then in a position to have far more control over the ultimate outcome.

However, as you can appreciate, Power can take on several forms. And just to give some examples, you could have the … [Read more…]

However, as you can appreciate, Power can take on several forms. And just to give some examples, you could have the … [Read more…]

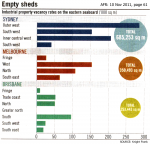

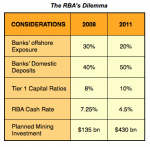

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market.

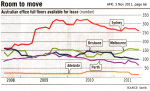

However, it’s important to do your homework; plus, understand that the Commercial market differs from the residential property market. The underlying fundamentals for Australia are strong.

The underlying fundamentals for Australia are strong. If you’re looking to purchase a Commercial property to occupy yourself, perhaps you should make it a two-step process — by first renting a property within the location you prefer.

If you’re looking to purchase a Commercial property to occupy yourself, perhaps you should make it a two-step process — by first renting a property within the location you prefer.