Reason #1: Lack of Research

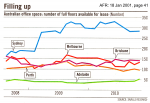

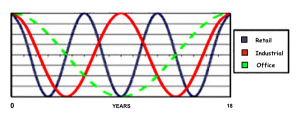

Most investors fail to properly research the market and understand the relationship each sector (office, retail & industrial) has with the local economy, nearby competition and the marketplace itself.

Most investors fail to properly research the market and understand the relationship each sector (office, retail & industrial) has with the local economy, nearby competition and the marketplace itself.

Reason #2: Poor Analysis

Many investors fail to thoroughly analyze and research their chosen properties as far as the overall economics, calibre of the tenant and any related risks that may be involved.

Reason #3: Lack of Commitment

Investing in Commercial property requires a reasonable degree of hands-on involvement. Some investors make the mistake of believing they can be absentee landlords. You at least need to be involved at a strategic level.

Reason #4: Over Borrowing

Negative gearing is fine. But you still need to start with sufficient equity, to ensure that your investment is not over-leveraged. Always keep some funds aside for unforeseen issues that may arise.

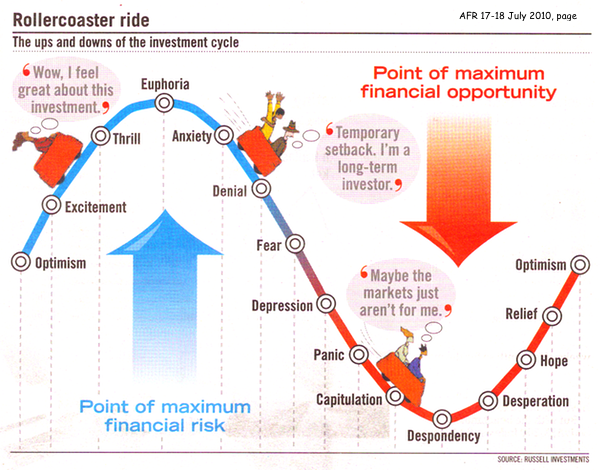

Reason #5: Lack of Understanding

The ownership of Commercial property needs a basic understanding of things like … tenancy law, building construction, how to add value, recognising market trends and so on. All of these can be very easily addressed.

Reason #6: Price vs Value

Some beginners tend to believe a cheap price means good value and a sound investment. Instead, you need to look behind what is being presented to discover the true underlying value.

Reason #7: Over Estimating Your Skills

To be a really successful Commercial investor, you need to build up a trusted team around you — to provide valuable input in the areas of …

- Analysis and due-diligence,

- Negotiating the purchase,

- Vetting the documentation,

- Ongoing property management,

- Determining the time to sell.

Reason #8: Lack of Diversity

After you’ve purchased your first property, you need to widen your perspective — both geographically, and across the various sectors of Commercial property. Never simply have all your eggs one basket.