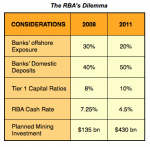

THE GENERAL consensus seems to be that the RBA will further reduce rates by 25 basis points. But can this view be fully justified; and what does all this mean for Commercial property investors?

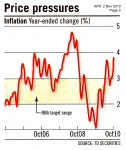

Most pundits would point to the recent CPI figures and say “Yes”! And on the surface, an underlying inflation rate of 2.5% per annum is plumb in the middle of the RBA’s stated target zone.

Most pundits would point to the recent CPI figures and say “Yes”! And on the surface, an underlying inflation rate of 2.5% per annum is plumb in the middle of the RBA’s stated target zone.

Yet despite what seems to be a rather hesitant mood by consumers, inflation in the service sector actually surged by massive 4.4% per annum. And some other sectors (not affected by overseas competition) also finished the year strongly, growing by 3.9% per annum. [Read more…]

Those experts included … Greg Marr (MD of DTZ), Tony Crabb (Research Head of Savills), together with me (as CEO of Properly Edge Australia).

Those experts included … Greg Marr (MD of DTZ), Tony Crabb (Research Head of Savills), together with me (as CEO of Properly Edge Australia).