.

AS A COMMERCIAL PROPERTY investor it’s important for you to keep tabs all the separate markets around Australia.

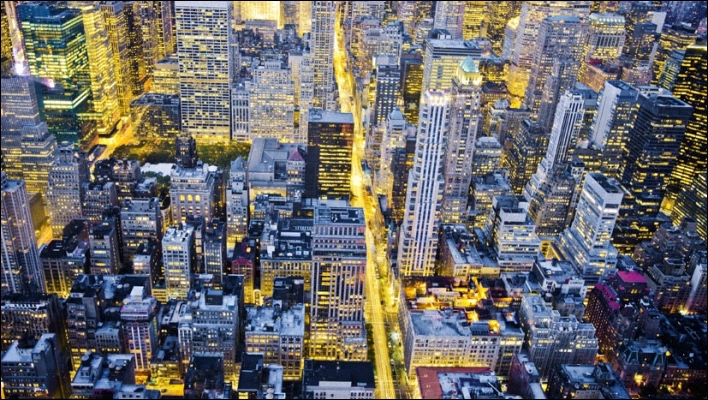

To help with that, a recent market update by Credit Suisse places in Sydney and Melbourne CBD Offices as the best performers over the next three years.

However, Brisbane and Perth are expected to deteriorate further from where they are at present. [Read more…]