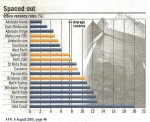

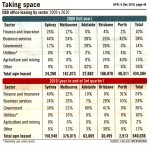

Office leasing activity picked up in most capital cities around Australia, over the past year. In some instances, quite significantly.

And with the supply side basically “on hold”, you should soon start to see this translate into some solid rental increases.

[Read more…]