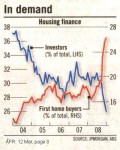

WILL COMMERCIAL property investors and businesses be starved of ready funds during 2012?

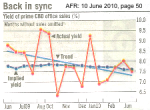

The banks seemed to be protesting about the increased cost of offshore borrowing. And using that as their excuse for not wanting to pass on any future RBA rate reductions in full.

The banks seemed to be protesting about the increased cost of offshore borrowing. And using that as their excuse for not wanting to pass on any future RBA rate reductions in full.

But are they really telling you the whole truth? [Read more…]

Exactly why have industrial companies around the world been slow to recover? And why did everything look so promising … and then suddenly, seem to grind to a halt?

Exactly why have industrial companies around the world been slow to recover? And why did everything look so promising … and then suddenly, seem to grind to a halt?