In last week’s article, you read a general overview of the Retail sector … and some of the issues currently confronting traders.

In last week’s article, you read a general overview of the Retail sector … and some of the issues currently confronting traders.

Let’s now take a quick look at three of the capital cities. [Read more…]

Insider Tips to Help You Discover How to Succeed with Commercial Property

>

From a very early age, Chris always sought to discover whatever the RULES might be for each situation – so he could quickly figure out how to master them. And from there, he has continued helping clients achieve their own Commercial Property success.

Read More In last week’s article, you read a general overview of the Retail sector … and some of the issues currently confronting traders.

In last week’s article, you read a general overview of the Retail sector … and some of the issues currently confronting traders.

Let’s now take a quick look at three of the capital cities. [Read more…]

Size-wise, as a proportion of Australia’s economy … Manufacturing and Mining contribute more or less the same output.

However, Mining’s investment spend is currently more than three times that being spent by the Manufacturing sector.

However, Mining’s investment spend is currently more than three times that being spent by the Manufacturing sector.

All the media attention has mainly been focused upon this disparity. But that doesn’t really tell you the complete story — as you can see from the first of these graphs. [Read more…]

AS YOU know, Property Edge Australia is there to help you in identifying and negotiating the actual purchase of your next Commercial property.

AS YOU know, Property Edge Australia is there to help you in identifying and negotiating the actual purchase of your next Commercial property.

However, you still require certain other key consultants, in order to make every deal really work for you.

And those consultants need to be thoroughly trustworthy.

As you can appreciate, I have had the opportunity to work with a quite number of consultants, over the past 40 years. And I’ve quietly put together a close team of those ones, who have really gone out of their way to look after my Clients’ best interests.

Over the next week or so, I will reveal to you who these Consultants actually are — in the vital areas of:

Anyway, let’s make a start on the first one today. [Read more…]

Around Australia, Commercial clearance rates at auction are now about on par with Residential property — averaging at around 50%.

Victoria seems to be leading the way, with Commercial clearance rates for some types of property approaching 70%.

New South Wales is running about six months behind at? around 60%, with firming yields. And Queensland is probably a further 12 to 18 months away in its recovery. [Read more…]

The Industrial sector was probably the one most harshly affected by the global financial crisis.

Nobody wanted to expand — being prepared to operate in cramped premises, until a clear picture of economic growth emerged.

However, there has been a growing and now, strong tenant demand reported within the main east-coast cities. [Read more…]

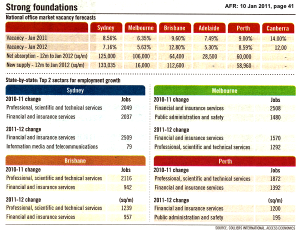

Within CBDs around Australia, the number of whole Office floors available to tenants is falling rapidly.

In the last post, you heard about the general decline in Office vacancy is within the capital cities.

But here, you’re looking at a situation where large corporate tenants will find it increasingly difficult to secure whole floors within quality buildings — according to Savills Research.

While Sydney still has a greater number of full floors available, these should quickly be taken up with increased activity from the finance and insurance sectors.

Bottom Line: This will put upwards pressure on Office rentals around Australia; and underpin good growth prospects for Commercial landlords, over the next 3 to 4 years.

What a difference a year can make to Office markets around Australia.

Twelve months ago, the rest of the world was anticipating double-dip recession.

Twelve months ago, the rest of the world was anticipating double-dip recession.

And white-collar employment was looking rather fragile here in Australia — particularly for Sydney, with its high exposure to the finance industry.

Even so, Melbourne’s office leasing market remained strong throughout all of last year.

[Read more…]

Last week, we talked about what you could be missing out on … when you find the need to move.

Whenever you decide to relocate to new Headquarters, what are the key things you are seeking to achieve? [Read more…]

Westpac has just released an Australia-wide outlook for Commercial property. And it predicts you will start to see growth in rents and values during 2010-11.

As employment numbers grow with the improved economy, demand for Office space will also take off again.Yesterday, the Federal government released Australia’s third Inter-generational Report.

And about five years ago, I came out with a somewhat startling statement:

“If you haven’t sold your traditional family home by 2010-11 … you had better be prepared to hold it until 2025 — because there simply won’t be a market for it!”

And given the recent surge in home sales (particularly in Sydney and Melbourne) over the past 6 months … you would be excused for thinking my prediction might be way off the mark. [Read more…]

By early December 2009, sales of Commercial property in Melbourne’s CBD had almost reached $1 billion — according to a report prepared by Jones Lang LaSalle.

Apparently, Melbourne office sales (for buildings over $10 million) totalled around $998 million — while in Sydney, it had reached $444 million.

Sales may well have topped the $1 billion mark by the end of December, because this strong activity resulted from private investors — particularly, in the region of $50 million.

And following another recent survey, more than half of Colliers’ client said they were expecting to see further growth in 2010.

In the suburbs, strata Office demand remained strong — with smaller owner-occupiers seeking Offices close to shops and main arterial roads.

WITH EVERY NEGOTIATION, you always need to be thinking on your feet. And here are several simple Tips to help you do just that.

WHEN YOU EMBARK on your journey as a property investor, it can be overwhelming – with a flood of information and diverse opinions. To help simplify the process, here are five essential tips for new (and seasoned) investors.

IT DOES NOT MATTER whether you’re an investor or an owner-occupier, there are several important factors to consider when purchasing a commercial property to ensure you make the right choice.

In a previous article, I shared a handy App to assist you in shortlisting potential properties. If you haven’t already downloaded it, simply click on the HiReturn Filter over on the right, to install it on your tablet or mobile device.

THERE IS A BELIEF among many experts that a surge in the stock market typically precedes a recovery in the commercial property market by about six months. And the start of this year saw equity markets gaining some momentum.

I HAVE BEEN ASKED countless times about the secrets to a successful negotiation. And I want to share with you the key elements to help make your negotiations effective.

But first, just watch this short video to gain a quick understanding of these three essential elements that form the foundation of every negotiation.

If you’re new to investing, you might be wondering if it’s possible to manage your own commercial property. The short answer is “yes”, but only if you know what you’re doing.

It’s important to note that owning a commercial property comes with certain legal responsibilities, particularly when it comes to compliance with Essential Services requirements under current Building Regulations.

The current trends in the business have made it clear that office landlords have to cater to the needs and preferences of their tenants. Building owners and managers (who understand and meet these demands) will be able to command higher rents and reduce vacancy rates.

To expand on this, here are four key tips to help attract quality tenants.

Hopefully, you will quickly realise this is not a website for self-promotion.

Rather, everything here has been put together to provide you (as a serious Investor) with the very best insights into what you need to know ... in order for you to succeed with your Commercial property investing.

You see, the deeper your access is to all the key information and the more expert opinions you can learn from ... the more likely your ultimate financial success will be.

That said, you will discover everything you need right here – both readily available, and all in one place.

All the very best ... Chris.

Copyright © 2024 · Genesis Child on Genesis Framework · WordPress · Log in