THE PROPERTY COUNCIL of Australia recently released their Office Market Report for the six months ending January 2019.

Both the Sydney and Melbourne markets have been the strong performers. Although, most capital cities have also seen an improvement in their vacancy rates.

Sydney (4.1%)

The Sydney CBD vacancy is down from 4.6% in July of last year. However it is expecting further space coming onto the market – up to 100,000 sqm between 2019 and 2020.

There have been a number of older properties withdrawn and converted into apartments. Plus, leasing agents are confident there will be significant pre-commitment for the upcoming new construction.

Melbourne (3.2%)

The vacancy rate in Melbourne has fallen from 3.6% in mid-last year. And average prime net effective rents have increased by 7% over the last 12 months, to around $430 per sqm. And the effect of this should start to filter out into the suburbs during 2019.

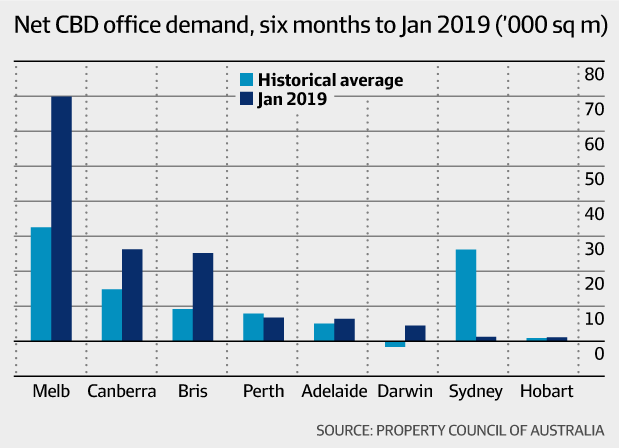

Between now and 2021, around 480,000 sqm of new space will come onto the market – however, over half of this is already pre-committed. And the graph below shows the extraordinary absorption rate occurring here in Melbourne.

Brisbane (13%)

Although still above the long-term average, Brisbane’s vacancy rate fell from 14.7% in June last year. And showed the largest decline of all capital cities.

Colliers confirm that this has been largely driven “by the public sector, professional services, education, construction, engineering and a resurgence from the mining sector – as well as an influx from global and Australian co-working organisations.”

Adelaide (14.2%)

With improved demand from the defence, mining and health sectors … the Adelaide vacancy rate has fallen from 14.7% in the past year. And it seems tenant demand is now beginning to gain some momentum.

Perth (18.5%)

The Perth vacancy rate remains the highest of all capital cities – despite the significant fall since mid-last year. Fortunately, there is little space coming onto the market; and tenant demand has been relatively consistent.

Canberra (11%)

There has been a tightening in Canberra’s vacancy rate, declining from 13.2% – with the likelihood of further improvement. And if Labor wins government this year, you can expect a surge in public servant hiring and therefore, more space being taken up than usual.

Bottom Line: Despite all the negative talk following the Royal commission, there will be a positive flow-on effect as far as the Office market is concerned. And that’s because the financial services, banking and legal professions will all need to house their specialist compliance teams – to start implementing the Hayne’s report recommendations.

Speak Your Mind