DESPITE A RECENT surge in positive COVID-19 cases for Victoria, the infection rates detected by its testing blitz have remained at a very low 0.2%.

And so, that would suggest the virus is not widespread within the community.

Furthermore, there hasn’t been any marked increase in the number of cases actually requiring hospitalisation.

Half of the Job Losses to be Back by Christmas

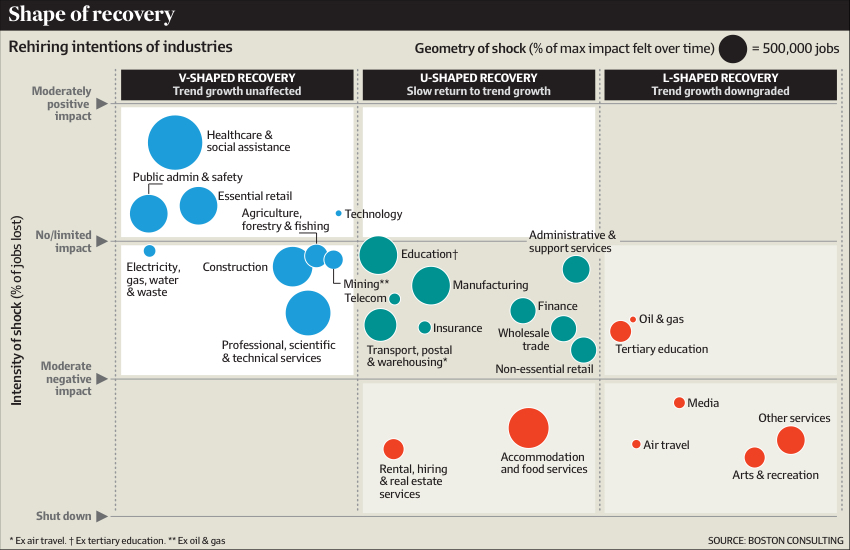

According to Boston Consulting, half the jobs lost through COVID-19 are in sectors expected to see a fast recovery.

Payroll data from the ATO confirms that around 950,000 jobs were lost between 14 March and 2 May. But Boston Consulting is expecting 570,000 of them to be re-established by December.

Overall, they estimate around 50% of the working population is employed in sectors likely to experience a V-shaped recovery. And these include healthcare, public administration, utilities and essential retail.

Also, mining and exploration are already now in hiring mode.

A further 32% of the working population is employed in sectors, which are likely to experience a U-shaped recovery. These would include education, manufacturing, finance and transport. Although there will be some jobs permanently lost.

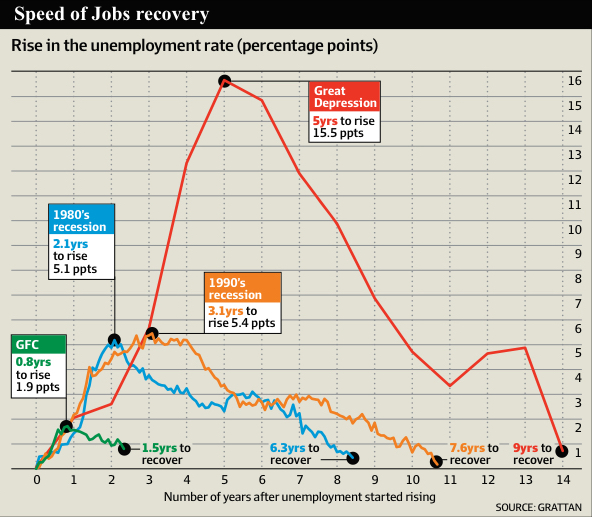

Historical Timeframe for Job Recovery

Below is a graph depicting the timeframes for Australia’s employment levels to return to where they were BEFORE previous major upheavals.

You need to remember that COVID-19 is a medical crisis … having financial implications.

However, there has not been a collapse of the entire financial system – as happened with the GFC. And for that crisis, the timeframe for returning to the original employment levels was only 1.5 years.

As such, the estimate by Boston Consulting of 50% re-employment by December, and a further 32% by mid-2021, would seem to be reasonable – assuming no further wholesale lockdowns.

Bottom Line: At the moment, the average person appears to have more cash in their bank account than at any time in the past 10 years – as a result of lockdown, and the massive government stimulus packages.

And as far as Commercial property is concerned, you’ll discover demand hasn’t disappeared … rather it has merely been deferred.

Already, several clients have quickly recognised this as being an ideal opportunity to make strategic purchases.

Speak Your Mind