WITH THE RECENT federal government announcement that small business owners are entitled to claim an immediate write-off for items worth up to $20,000, many commercial property owners may be wondering about what deductions they are entitled to.

Property Edge Australia has enjoyed a longstanding relationship with BMT Tax Depreciation.

BMT are Quantity Surveyors who specialise in providing tax depreciation schedules for all types of income producing properties — including commercial properties used for retail, offices, manufacturing, industrial, travel and accommodation.

According to BMT’s Chief Executive Officer, Brad Beer, 80% of commercial property owners fail to maximise the deductions they can claim from their property.

Yet, depreciation claims are an important key to help commercial property owners improve their available cash flow.

Property Depreciation

So what precisely is property depreciation, you ask?

As a building gets older and the items within it age, they depreciate in value. The Australian Taxation Office (ATO) recognises this and allows commercial property owners and investors to claim deductions relating to the wear and tear on a building and the plant and equipment items contained within.

Capital works deductions can be claimed for the structure of any commercial building in which construction commenced after the 20th of July 1982.

The rate it can be claimed is either 2.5% or 4% per year. This does not necessarily mean that the owners of older properties cannot claim capital works deductions.

If a building has had any renovation work completed, the new owner may still be entitled to a claim for these structural improvements, so long as the work took place within the ATO’s legislated dates.

This applies even if the work was completed by a previous owner of the property.

Depreciation Deductions

Depreciation deductions can also be claimed for any of the plant & equipment assets found within a property.

Examples include carpets, air conditioners, blinds, hot water systems, light fittings, partitioning and bathroom accessories.

These assets generally depreciate based on an individual effective life set by the ATO.

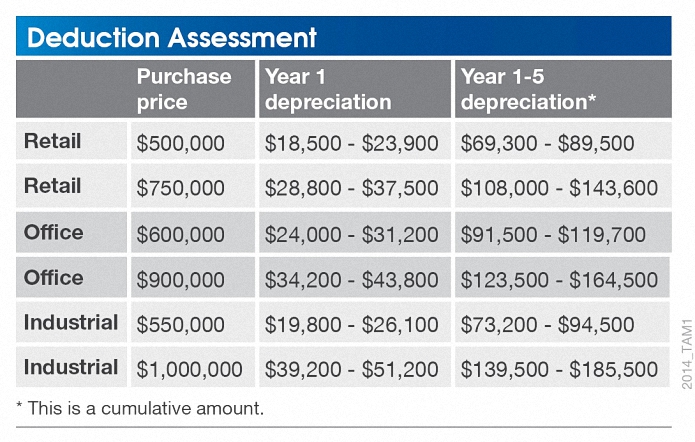

The following table provides examples of the deductions that can be found for commercial property owners.

Working out the deductions available in a commercial property can be quite complicated, so it is recommended to consult with a specialist Quantity Surveyor and request a tax depreciation schedule.

Seeking Professional Help

Quantity Surveyors are one of a few select professions with the expert knowledge required to calculate construction costs for depreciation purposes.

As tenants also are entitled to deductions for any fit-out they add to the property from the starting date of their lease, it can be difficult for owners to work out their deductions correctly without seeking advice.

When a commercial property owner requests a depreciation schedule from a professional, it will include a full site inspection to ascertain what items are contained within the property.

They will take detailed photographs and notes and outline all of the deductions available in the schedule to allow the owner to make their claim. This schedule and the detailed notes kept help to substantiate an owner’s claim when completing their annual income tax assessment.

Bottom Line: All businesses are entitled to immediately write-off assets worth less than $300.

However, to be eligible for the recent $20,000 small business instant asset write-off, a business must have a turnover of less than $2 million dollars per year.

The instant write-off is available for items purchased between 7:30pm on the 12th of May 2015 and the 30th of June 2017. Assets outside this threshold can continue to be claimed based on their individual depreciable rate as set by the ATO.