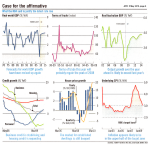

The Reserve Bank of Australia (RBA) is not seeing the Australian flood disasters as having a prolonged effect upon the national economy.

It certainly expects the March quarter GDP to decline by 0.5%. But it is then projecting a 4.25% surge, over the remainder of this year. [Read more…]