OVER THE PAST several months, I have been recommending you refrain from trying to pick the bottom of the Commercial property market.

OVER THE PAST several months, I have been recommending you refrain from trying to pick the bottom of the Commercial property market.

And certainly not wait for overwhelming evidence of prices being “on the up”.

Anyway, last week you were probably given the best confirmation you needed in an article by Carolyn Cummins (The Age, BusinessDay: 24 Jan 2013).

In the article, she talked about high net-worth investors having now joined institutional investors & sovereign funds, at the top end of the Commercial property market.

Driven by lower interest rates, demand has increased for health-care properties and large-scale shopping centres; plus traditional offices and industrial property. [Read more…]

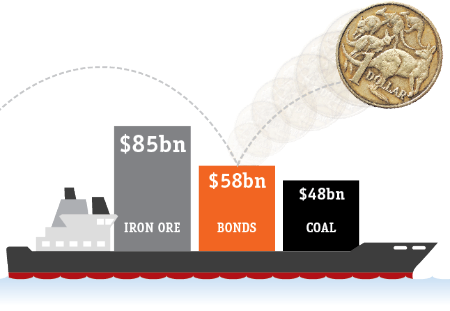

And as the table shows, this is moving closer to Australia; and will bring with it an increase in … specialisation, innovation, productivity and income.

And as the table shows, this is moving closer to Australia; and will bring with it an increase in … specialisation, innovation, productivity and income.