.

Is there a Future for Offices?

The last couple of articles have talked about all the misplaced doom and the gloom.

The last couple of articles have talked about all the misplaced doom and the gloom.

Plus, you also covered the various reasons why Australia overall is well placed to flourish (and not just survive) the current global distress.

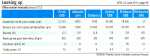

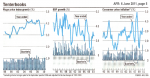

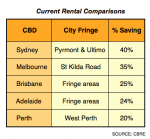

A recent report on the Australian Office scene (by Morgan Stanley property research) would only tend to confirm that view. Their only concern would be the Sydney market, due to its heavy exposure to the financial sector. [Read more…]

For the past few weeks, the world’s media seems to have been dominated by two unfolding dramas:

For the past few weeks, the world’s media seems to have been dominated by two unfolding dramas:

Wherever you live, you tend to believe (and will happily tell people) that it is undoubtedly the

Wherever you live, you tend to believe (and will happily tell people) that it is undoubtedly the