Office Vacancy rates around Australia are falling — albeit faster in some capital cities, than others.

The chart below shows you where things currently stand.

[Read more…]

Insider Tips to Help You Discover How to Succeed with Commercial Property

>

From a very early age, Chris always sought to discover whatever the RULES might be for each situation – so he could quickly figure out how to master them. And from there, he has continued helping clients achieve their own Commercial Property success.

Read MoreOffice Vacancy rates around Australia are falling — albeit faster in some capital cities, than others.

The chart below shows you where things currently stand.

[Read more…]

Whenever Investors are confused … the Property Market tends to do nothing and simply moves sideways.

Confusion Reigns

People simply put their buying decisions ‘on hold’. And then, frantically played catch-up over the last 12 months … as soon as they realised things were still okay here in Australia.

Over that period, you have seen most Commercial markets around the country showing good growth — particularly in Melbourne.

[Read more…]

The other day, we took a look at Commercial property cycles, and where the various Australian CBD office markets might sit.

Currently, Melbourne seems to be “leading the pack”. But you might be interested to explore exactly why that is.

Several pundits are suggesting it could be even lower.

h3. And the reason why?

[Read more…]

Overall, Australia has sailed through the Global Financial Crisis more or less unscathed. And from all accounts, Victoria and enjoys the standout economy of all the States.

Last week, you explored the traditional cycle for CBD Offices — being 18 years from peak to peak. And over that same period, Retail and Industrial properties tend to go through several cycles.

However, given Australia’s privileged position within the global scene … my view is you are now at the upswing in the cycle for the Office market. In other words, you are already at the halfway point in the traditional Cycle.

[Read more…]

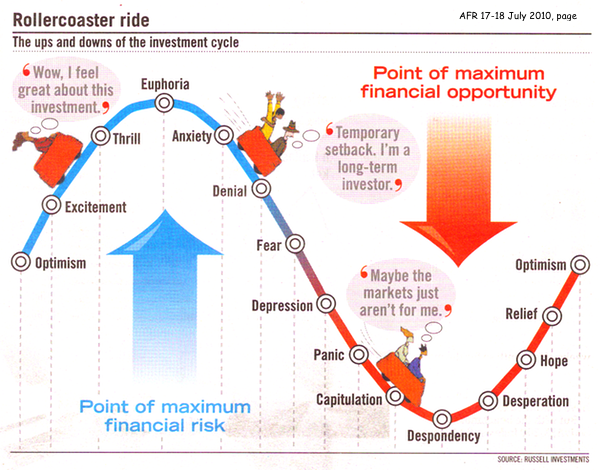

Before talking to you about Commercial property, let’s take a quick look at Investment Cycles in general.

A recent AFR article contained this rather clever chart … showing an Investor’s mood at different points throughout the Cycle.

A recent AFR article contained this rather clever chart … showing an Investor’s mood at different points throughout the Cycle.

My reading would be that Australia is currently at the “Optimism” stage of the upturn — perhaps with some capital cities, a little more so than others. But generally, that’s about where most of us are at the moment.

[Read more…]

Last week, we talked about what you could be missing out on … when you find the need to move.

Whenever you decide to relocate to new Headquarters, what are the key things you are seeking to achieve? [Read more…]

On several occasions over the past fortnight … I have had to give this very same advice. And so, I thought it might be worthwhile exploring this in some detail with you.

What we’re actually referring to are the times when you need to relocate your Firm’s headquarters. And in the process, unwittingly forego considerable benefits that are rightly yours.

[Read more…]

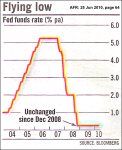

The US Federal Reserve is concerned that consumption is still being underpinned by government funding.

And so, even though stimulus measures may be winding down … the Fed has decided to maintain interest rates at their historically low level.

And so, even though stimulus measures may be winding down … the Fed has decided to maintain interest rates at their historically low level.

It seems that households and businesses are preferring to repay debt, rather than spend to encourage investment and growth.

In Europe, there is still simply not enough trust between Banks to lend to one another. And that means credit is extremely tight. Right now, Central Banks are stepping in to lend to private banks, in an attempt to free up funds to boost economic activity.

China still remains the bright light with its growing demand for of the commodities Australia exports.

The IMF actually predicts that the Asian economy (which includes Australia) will be 50% larger within five years.

And it will then represent about a third of the world’s trading activity.

h2. The Implications for Commercial Property

Already, major Asian sovereign wealth funds and property trusts are starting to target Office towers within Australian capital cities.

Already, major Asian sovereign wealth funds and property trusts are starting to target Office towers within Australian capital cities.

In fact, foreign buyers have invested around $1.7 billion during the past 12 months — representing about 70% of the purchase is made.

While this won’t directly affect the smaller private buyer … it will force everyone to move down a price bracket ought to — looking for better value.

Therefore, as yields quickly firm at the upper levels … this will soon have a ripple effect down through more modestly priced Commercial investment property.

Couple this with rising rentals, as the supply of Office space starts to fall around Australia … and now would be the perfect time to position yourself, ready for the next growth cycle.

The RBA’s decision on interest rates yesterday came about because of what’s happening here in Australia, rather than in Europe.

It has been made against the backdrop of our exporters having recently extracted massive price hikes for iron or in coal, as a result of China’s strong growth.

This has more or less offset the rise in Australia’s local retail prices, through a sharp decline in the cost of imported items — like electrical goods, clothing, footwear and furniture.Since the global turmoil started in 2008, the $A has climbed by nearly 55% against the $US — and just over 40% against our other key trading partners.

As a result, the NAB’s business confidence index stands firmly positive for the third consecutive quarter. And even more importantly, actually improved throughout the last quarter.

h2. How will this affect Commercial Property?

[Read more…]

The latest figures show unemployment crept up from 5.2% to 5.3% last month — probably due to school leavers. However, the total number of hours worked actually jumped by 2.4% during February.

With predictions of a 60% surge in commodity prices from next month’s contract re-negotiations, this will put further strain upon the labour and capital resources of both New South Wales and Victoria.Westpac has just released an Australia-wide outlook for Commercial property. And it predicts you will start to see growth in rents and values during 2010-11.

As employment numbers grow with the improved economy, demand for Office space will also take off again.

WITH EVERY NEGOTIATION, you always need to be thinking on your feet. And here are several simple Tips to help you do just that.

WHEN YOU EMBARK on your journey as a property investor, it can be overwhelming – with a flood of information and diverse opinions. To help simplify the process, here are five essential tips for new (and seasoned) investors.

IT DOES NOT MATTER whether you’re an investor or an owner-occupier, there are several important factors to consider when purchasing a commercial property to ensure you make the right choice.

In a previous article, I shared a handy App to assist you in shortlisting potential properties. If you haven’t already downloaded it, simply click on the HiReturn Filter over on the right, to install it on your tablet or mobile device.

THERE IS A BELIEF among many experts that a surge in the stock market typically precedes a recovery in the commercial property market by about six months. And the start of this year saw equity markets gaining some momentum.

I HAVE BEEN ASKED countless times about the secrets to a successful negotiation. And I want to share with you the key elements to help make your negotiations effective.

But first, just watch this short video to gain a quick understanding of these three essential elements that form the foundation of every negotiation.

If you’re new to investing, you might be wondering if it’s possible to manage your own commercial property. The short answer is “yes”, but only if you know what you’re doing.

It’s important to note that owning a commercial property comes with certain legal responsibilities, particularly when it comes to compliance with Essential Services requirements under current Building Regulations.

The current trends in the business have made it clear that office landlords have to cater to the needs and preferences of their tenants. Building owners and managers (who understand and meet these demands) will be able to command higher rents and reduce vacancy rates.

To expand on this, here are four key tips to help attract quality tenants.

Hopefully, you will quickly realise this is not a website for self-promotion.

Rather, everything here has been put together to provide you (as a serious Investor) with the very best insights into what you need to know ... in order for you to succeed with your Commercial property investing.

You see, the deeper your access is to all the key information and the more expert opinions you can learn from ... the more likely your ultimate financial success will be.

That said, you will discover everything you need right here – both readily available, and all in one place.

All the very best ... Chris.

Copyright © 2024 · Genesis Child on Genesis Framework · WordPress · Log in