ONLY RECENTLY, I flagged the emerging opportunity being provided by Industrial property. But I felt it was important for you to understand the underlying reason for that.

In a nutshell, it comes down to our persistently high dollar.

In last weekend’s Financial Review (page 24), Joanna Heath posed the following question:

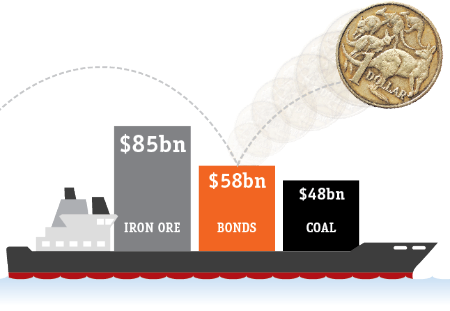

Can you name Australia’s second-largest export?

She went on to point out that it’s not … coal, gas or wheat. Instead, it is actually Australian Commonwealth Bonds! [Read more…]