EVERY capital city has both a CBD and suburban Office market. And as you can appreciate, keeping tabs on all the various suburban markets is almost an impossible task for most investors.

But generally speaking, the health (or otherwise) of the CBD Office markets within each capital city will provide you with a fairly good gauge of the overall Office scene around Australia.

But generally speaking, the health (or otherwise) of the CBD Office markets within each capital city will provide you with a fairly good gauge of the overall Office scene around Australia.

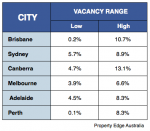

Accordingly, this graph will provide you with a clear picture of what has occurred over the past 4 years.

As a rule of thumb, Office markets are said to the “in balance”, when their Vacancy Rate lies between 5% and 7%.

Because within this range, Landlords can receive consistent rental growth … and Tenants have the ability to relocate or expand, with few constraints.

As a Commercial property investor, what you are seeking is solid predictable growth — rather than wildly frustrating fortunes.

So let’s take a quick look at how the vacancy rates for each capital city have fluctuated over the past 4 years.

So let’s take a quick look at how the vacancy rates for each capital city have fluctuated over the past 4 years.

As you can see from this table and graph … of all the capital cities, Melbourne remained pretty much within the “balanced” range over this period — despite the global turmoil.

Whereas, once the turmoil struck:

- The vacancy rate for Brisbane, Perth and Adelaide overshot that balanced range … in the opposite direction.

- Sydney’s vacancy rate remained around 8%, because of its high concentration of financial institutions; and

- Canberra’s high vacancy rate simply reflected some major government relocations.

Throughout this period, the Melbourne market experienced only a 2.7% spread between its lowest and highest vacancy rate.

Whereas, Brisbane and Perth experienced spreads of 10.7% and 8.3%, respectively.

Such wild fluctuations can bring untold joy … as long as you’re lucky enough to get out BEFORE the inevitable collapses, which tend to occur in these rather volatile markets.

That way, you can avoid the accompanying financial heartache.

Bottom Line: If you’re like most investors, you probably prefer being able to sleep peacefully — knowing that your growth is predictable and secure.

Therefore, unless you are an experienced on-the-ground trader in Commercial property … you would be well advised to steer clear of the rather volatile markets, in both Brisbane and Perth.

Right now, you Melbourne offers you the greatest surety of long-term profit for Commercial property — with Sydney expected to respond, once the financial turmoil subsides.

Speak Your Mind