CONTRARY TO THE VIEW of many pundits, it’s certainly not all gloom and doom out there.

CONTRARY TO THE VIEW of many pundits, it’s certainly not all gloom and doom out there.

The share market may well have been moving sideways within a 4000 to 5000 band, since 2009.

Plus, the two-speed economy only seems to be benefiting the miners and those within the service industries. And unfortunately, increased savings levels are frustrating the retailers no end.

However, my view remains that Australians are now poised ready to come off the bottom of the “Emotional Cycle” — armed with a level of savings seldom seen in previous upturns.

Commercial Property Remained Solid

Following the GFC, investors obviously needed to reduce their debt levels. As such, this forced vendors into lowering their expectations and becoming more realistic in their pricing.

However, on balance, the Commercial property market has remained remarkably stable.

With banks hesitant to lend on anything risky, most speculative development projects were shelved. And this has prevented a blowout in vacancy rates, across all sectors of the Commercial property market.

Demand for Commercial Property

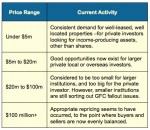

While the market overall has been resilient, the various price ranges have had to confront different issues.

While the market overall has been resilient, the various price ranges have had to confront different issues.

And this table will give you a quick snapshot of how each segment has coped so far.

Bottom Line:

The lead-time for new Office construction is anywhere from 3 to 5 years — depending upon its size and location. Therefore, with the vacancy rates for most capital cities at relatively low levels … this will tend to give landlords the upper hand, over the next 3 to 5 years.

Several previous articles have highlighted the switch in Retail outlets from specialty shops, to restaurants & cafes. And that should be your focus going forward, if you intend investing in retail property.

Because of the high dollar, the demand for Industrial property has been with warehousing — rather then new manufacturing facilities. And with little new development occurring after the GFC, this has ensured early commitment by tenants.

Therefore, you simply need to step back and study the bigger picture.

Speak Your Mind