IT’S EASY FOR business people, like pharmacists, to get so caught up in their day-to-day schedule … that they don’t stop to think about what tax deductions they could be claiming.

Of all of the tax deductions commercial property owners and their tenants can claim, depreciation is the deduction most commonly missed.

Depreciation deductions relate to the wear and tear of the building and any of the plant and equipment assets a commercial property contains.

Anyone can Claim

For every commercial property, both owners and tenants are entitled to claim depreciation deductions.

Owners of the building can claim capital works deductions for the building structure so long as the property commenced construction after 20th of July 1982. They can also claim any existing plant and equipment assets contained in the property.

In a situation where a building is leased, tenants can claim deductions for any fit out they add to the property from the starting date of their lease.

And if you do operate a pharmaceutical business and you’re wondering just what deductions you can claim, take notice of some of the items outlined in the below graphic that your building may contain when you next walk into the store.

It is important that both commercial property owners and their tenants each obtain a comprehensive tax depreciation schedule from a Specialist Quantity Surveyor which outlines the deductions that can be claimed.

You need a Fully-documented Analysis

A site inspection of the property will be performed whereby an expert will take detailed notes and photographs of the assets contained and measurements to determine deductions for building and other structural items.

Quantity Surveyors are recognised under Tax Ruling 97/25 as one of a few select professionals with the expert knowledge required to calculate construction costs for depreciation purposes.

The cost of obtaining a tax depreciation schedule is 100 per cent tax deductible. Both owners and tenants can benefit significantly from the thousands of dollars in deductions which can be claimed.

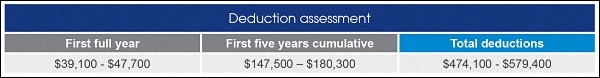

The following example provides an example of the deductions the owner of one pharmacy could claim.

In this scenario, the pharmacist owned the building and the business so they were entitled to claim both capital works deductions and plant and equipment depreciation for any fit out found in the property.

Deductions you could be missing out on …

Bottom Line: Commercial property owners and tenants really made to gain a better understanding of their entitlement when it comes to Tax Depreciation Benefits.

Speak Your Mind