OPTOMETRISTS SPEND ALL DAY looking at their client’s eyes in order to assist them with their sight.

It’s therefore understandable that a busy schedule might result in unforeseen deductions for the depreciable items contained in their business.

Many Optometrists are missing out on the additional cash flow that claiming depreciation for the building structure, plant and equipment assets contained within their properties can provide them with.

Depreciation Deductions: What Is Covered?

There are numerous industry assets that Optometrists can claim back for using depreciation deductions, and some of them have been listed below:

- Analogue and digital cameras

- Reception furniture

- Display shelving

- Keratometers

- Colour vision testers

- Examination chairs

- Refractometers

- Air conditioning unit

- Light fittings

Assets such as these are expensive, so any deductions an Optometrist can claim which will reduce tax are worth finding out about.

Deductions claimed from depreciation can be worth thousands of dollars at tax time for Optometrists.

Case Study

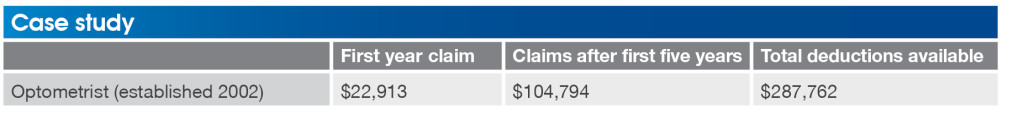

Let’s take a look at an example of the total deductions one Optometrist was able to claim for their business which was established in 2002.

In this particular example, the Optometrist also owns the ten year old building they operate within and therefore they could claim depreciation for both the building structure and the depreciable assets contained within their property.

The depreciation deductions in this case study have been calculated on the diminishing value method of depreciation.

As the table shows, this Optometrist could claim $22,913 in the first financial year alone.

Claims after the first five years totalled to $104,794 and over the life of the property (forty years), the Optometrist could claim back $287,762 in deductions, which is a healthy cash injection for any business.

To claim the depreciation deductions for a commercial property used as an Optometrist clinic or for any industry type, speak with a specialist Quantity Surveyor at BMT Tax Depreciation.

BMT are vastly experienced in providing depreciation services for a broad range of properties from commercial, industrial, special use, aged care and education facilities to retail office buildings and even theme parks.

Bottom Line: It goes to show that depreciation deductions can provide significant additional cash flow for any commercial property owner.?