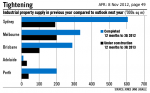

BECAUSE banks have been reluctant to fund speculative development, very little new Industrial space has come onto the market over the past few years.

BECAUSE banks have been reluctant to fund speculative development, very little new Industrial space has come onto the market over the past few years.

Demand on the other hand has remained fairly steady; and it’s now increasing.

And this will cause rentals to rise over the next few years — as there is only a modest amount of space in the pipeline.

According to a recent report by Jones Lang LaSalle, 90% of the space built over the past year was through pre-committed.

According to a recent report by Jones Lang LaSalle, 90% of the space built over the past year was through pre-committed.

And with vacancies falling, you are likely to see these pre-commitments continue — as businesses start to expand, or relocate from all the premises.

In Sydney, owner-occupiers have dominated the sales market — causing investment yields and prices to firm. And with a looming tight supply, you should see values rise during 2013.

Whereas, Melbourne has seen a continuing shortage of prime space over 3000 sqm, due to strong tenant demand. As such, many tenants are having to settle for second-grade accommodation.

The success of several speculative projects in the West & South East has encouraged a few cached-up developers to begin further projects. But even so, the amount of new space coming onto the market will be modest — thereby sustaining growth.

Queensland‘s mining activities have meant a quarter of all major lettings have been taken up by companies servicing the mining sector. Nonetheless, the demand by manufacturers and wholesalers remains strong; with most investors seeking quality tenants, on long leases in modern buildings.

It would seem that strong tenant demand in Adelaide, combined with new space be in short supply … have combined to cause some steady growth in rentals over the past 6 months.

Lack of ready funding in Perth has so far curbed speculative development — with most new construction being undertaken following tenant pre-commitments. However, with vacancies low and and demand strong, development activity is expected to increase over the next couple of years.

Bottom Line: If you are in a position to contribute the land as your “project equity”, then banks will generally fund projects with just 50% pre-commitment.

And in the current market, you are likely to have your project fully leased (or sold) prior to completion.

Speak Your Mind