COMMERCIAL PROPERTIES are often renewed and transformed to suit the ever-changing needs of their occupants.

Scrapping occurs when removed assets and structural elements within a building have a remaining un-deducted value. At the time of removal, as the owner of the asset, you can claim that remaining value as an immediate deduction in that financial year.

Often overlooked, these valuable deductions apply to both removable plant and equipment assets (under Division 40) and the fixed assets or structural capital works elements of a building (under Division 43).

The deductions for structural or fixed assets are especially valuable when scrapping occurs. These assets are written off at a much lower rate over forty years at 2.5% per year, often resulting in a substantial remaining undeducted value for the owner to claim in its entirety when removed.

Landlords and Tenants can Benefit

Both commercial building owners and tenants can boost their cash flow with depreciation and capital works deductions when assets are being used. Therefore, both parties can claim scrapping deductions when assets are removed.

Owners can claim deductions for the building structure, any plant and equipment assets they own or fit-out they purchase and install.

Meanwhile, commercial tenants can also claim deductions for fit-out they own from the starting date of their lease or from the date of purchase and installation. This includes assets such as desks, kitchens, carpet and partitions.

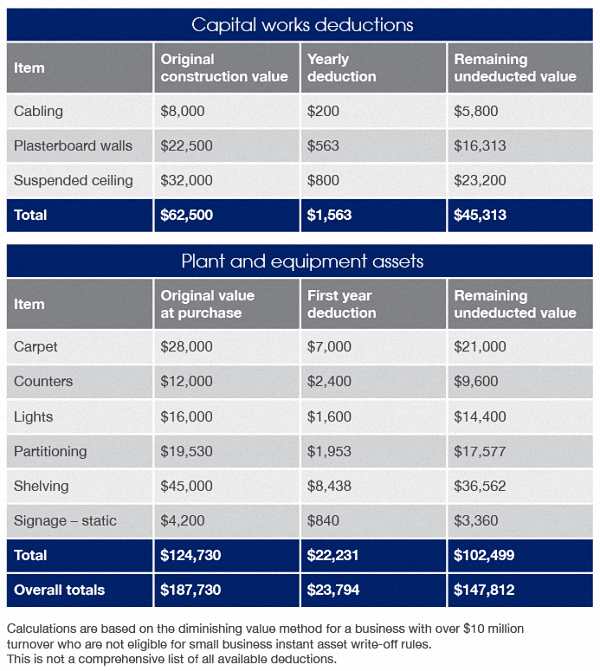

The following information is taken from a BMT Tax Depreciation Schedule completed for a recently purchased 400 square metre retail property.

In the scenario, the owner of the property was updating the fit-out after owning the property for one year. The fit-out was installed eleven years ago by the previous owner.

As the example shows, the owner could claim $23,794 in plant and equipment depreciation and capital works deductions. After one year there is a total residual value of $45,313 for capital works and $102,499 for plant and equipment.

Bottom Line: By claiming scrapping for the items removed, the owner can claim a total deduction of $147,812 in the year of the items’ removal. They can also claim deductions for the newly installed fit-out.

Prior to removing any fit-out, it’s crucial that assets have been properly assessed. Business owners and tenants should speak with a specialist Quantity Surveyor to ensure they don’t miss out on any eligible deductions.

Speak Your Mind