The Reserve Bank of Australia (RBA) is not seeing the Australian flood disasters as having a prolonged effect upon the national economy.

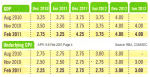

It certainly expects the March quarter GDP to decline by 0.5%. But it is then projecting a 4.25% surge, over the remainder of this year.

Although the RBA does not expect any long-term impact on inflation through food and skills shortages during the rebuilding process … it does sees the mining boom sustaining Australia’s growth rate at between 3.75% and 4% for the next 2 to 3 years.

Although the RBA does not expect any long-term impact on inflation through food and skills shortages during the rebuilding process … it does sees the mining boom sustaining Australia’s growth rate at between 3.75% and 4% for the next 2 to 3 years.

On that basis you would expect it to maintain an upward bias on the cash rate.

The RBA’s forecasts come from an improved global scene — where China is growing strongly, Asia has resumed its growth cycle and the US is displaying consistently good signs of recovery.

Plus, commodity prices are also on the rise.

Even so, the RBA is expecting consumers to remain coy over the next few years — with the level of household savings hovering around 10% of disposable income, which will helped constrain domestic spending levels.

Looking forward: Make sure you keep a close eye on the level of consumer spending — because this is what will determine the RBA’s attitude towards future increases in the cash rate. And those increases probably won’t begin again, until towards the second half of this year.

Nonetheless … the Big Four banks may well decide to pre-empt the RBA (or impose an even greater increase), if the cost of their wholesale funds starts to become too expensive.

Therefore with this current lull, you may just be seeing the last opportunity you have to lock-in your interest rate for the longer term.

Speak Your Mind