How do you ever understand them?

Before talking to you about Commercial property, let’s take a quick look at Investment Cycles in general.

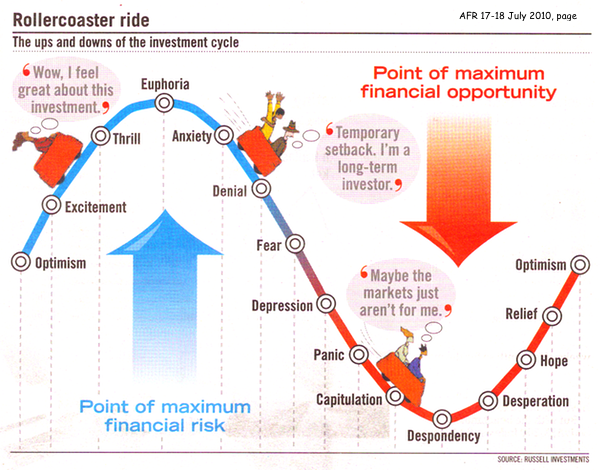

A recent AFR article contained this rather clever chart … showing an Investor’s mood at different points throughout the Cycle.

A recent AFR article contained this rather clever chart … showing an Investor’s mood at different points throughout the Cycle.

My reading would be that Australia is currently at the “Optimism” stage of the upturn — perhaps with some capital cities, a little more so than others. But generally, that’s about where most of us are at the moment.

[Read more…]