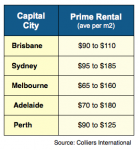

Vacancy rates for Industrial property have fallen dramatically over the past year — declining by 39% on average, across the country.

Vacancy rates for Industrial property have fallen dramatically over the past year — declining by 39% on average, across the country.

This is mainly the result of strong demand for warehousing, following the high Australian dollar.

Plus, there has only been a modest amount of new construction. And that means you should see rentals improve and selling yields start to firm. [Read more…]

OVER THE past couple of weeks, you’ve quietly worked your way through the first 14 questions … as part of your prep-work for each Negotiation.

OVER THE past couple of weeks, you’ve quietly worked your way through the first 14 questions … as part of your prep-work for each Negotiation.