Many investors just simply fall in love with Retail property. And probably, because of familiarity — as it tends to influence so much of our daily lives.

Many investors just simply fall in love with Retail property. And probably, because of familiarity — as it tends to influence so much of our daily lives.

Therefore, after investing in Residential property for a while, you find people will gravitate naturally towards Retail properly.

To them, it seems to be the next logical step. But is that actually the case? [Read more…]

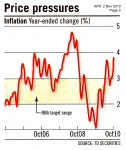

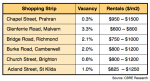

You’ve been aware of my general concern with the Retail sector over the past few years. And that’s because the fundamentals are out of alignment.

You’ve been aware of my general concern with the Retail sector over the past few years. And that’s because the fundamentals are out of alignment.