BEING A COMMERCIAL property owner, the Australian tax system allows you to claim a deduction from your income.

BEING A COMMERCIAL property owner, the Australian tax system allows you to claim a deduction from your income.

And that relates to the wear and tear upon the structure of a commercial property, and the depreciation of the plant and equipment items it contains.

Depreciation is available to all property owners who generate an income from that property. But the secret is to make sure you maximise these deductions, to boost your bottom-line cash flow.

By maximizing your tax depreciation deductions every financial year can make a huge difference to the tax you pay. And it may even result in the ATO paying money back to you, at the end of the year.

A few facts about Depreciation for Commercial Properties

- Your investment property does not have to be new: Most properties, both new and old, will attract some depreciation deductions. A common myth is that older properties will attract NO claim. And so, every property is worth enquiring about.

. - Your previous years’ tax returns can be amended. If depreciation has not been claimed or maximised in the past, the previous two financial years can usually be amended.

. - A specialist will ensure you maximise your claim: Quantity Surveyors are recognised by the Australian Tax Office (under TR 97/25) and appropriately qualified to estimate construction costs of a building for depreciation purposes.

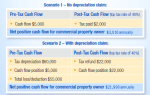

In this example … you can see the difference that a tax depreciation report could make to a Commercial property purchased for $1 million, and rented for $90,000 pa.

In this example … you can see the difference that a tax depreciation report could make to a Commercial property purchased for $1 million, and rented for $90,000 pa.

The property incurs various expenses (including building outgoings and interest) of approximately $85,000 pa — leaving a taxable income of $5,000.

Bottom Line: By also claiming depreciation, you’re able to improve your cash flow by by $18,980 per annum — which is not bad outcome.

Anyway, this is just one of the little gems that BMT Tax Depreciation will be exploring over the coming weeks.

Speak Your Mind