THERE WAS A FAVOURABLE response to the so-called Phase 1 breakthrough in the Trade Talks, between the US and China. And there’s been further positive developments this week.

However, it is actually worth reviewing where things stood before these recent events.

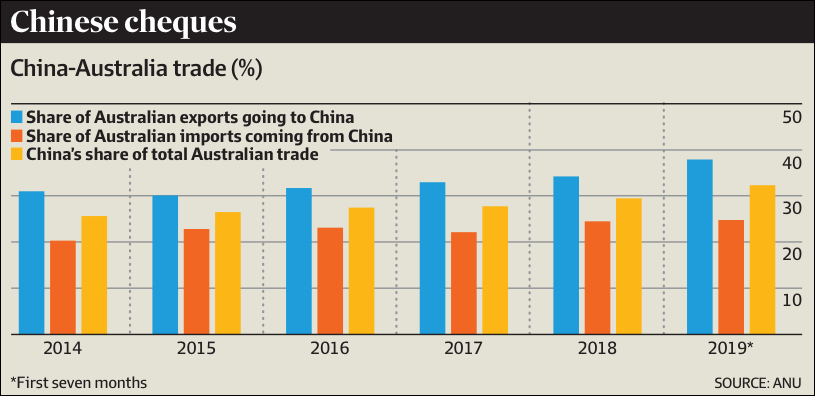

Despite political tensions, there has been little adverse impact on Australia’s trade with China. And the rapid increase in China’s share of our exports has been principally driven by higher iron ore prices.

However, research by Australian National University shows this is not simply because of shortages stemming from Brazil’s Vale dam disaster. Because, at the same time, China has shown a greater appetite for basic commodities.

Right now, China takes 38% of Australia’s exports – which is already up from 34% last year. Whereas, Japan’s share has progressively declined, from its 1976 peak of 30%.

Right now, China takes 38% of Australia’s exports – which is already up from 34% last year. Whereas, Japan’s share has progressively declined, from its 1976 peak of 30%.

This switch comes about from China increasing its external sourcing for its steel industry – up from 81%, to the current level of 90% of purchases. And includes 74% of its iron ore requirements from Australia, in June this year

That has been one of the primary driver behind Australia’s export growth – and not solely what occurred in Brazil.

Moreover, there has been greater diversity occurring, as Chinese incomes have grown. This has spread to sectors like beef, wine, vitamin supplements, dairy products and education.

Bottom Line: From reviewing all of this, it becomes clear that Australia’s exposure to these Trade Wars has been far less than expected. And the recent Phase 1 development should only see things improve.

As such, there should be little that will provide any adverse impact on the commercial property market, in the foreseeable future.

Speak Your Mind