According to the recent Property Council (PCA) report in the Financial Review (AFR) … the 6 months to June saw overall demand for offices fall around Australia — as business confidence has gradually waned throughout the world.

However, unlike the early 1990s, vacancy rates still remain low in all Capital cities. And at this stage, there is no oversupply — simply a slow down.

p=.

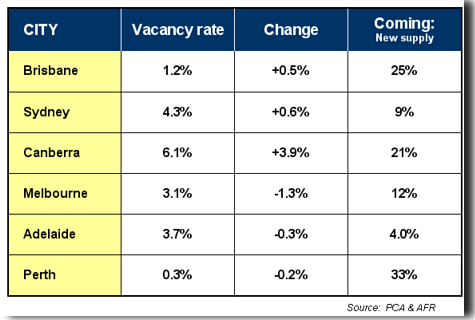

As you review the table, you’ll see Brisbane and Perth vacancy rates remain very low. Prime rentals for both have been hovering around the $1,000 per sq metre mark. However, rentals in Brisbane are now falling; whereas Perth rents are still on the rise.

Perhaps the worrying aspect for both these cities is that their total office stocks are due to increase by 25% and 33% respectively.

The vacancy rate for Sydney increased slightly from 3.7% to 4.3%; but its level supply seems to be balanced.

Interestingly, the vacancy rate for Melbourne has fallen to 3.1% — it’s lowest ever. And Adelaide has firmed to 3.7%.

Of all the cities, those two seem the least affected by global events. As such, you should see both Melbourne and Adelaide enjoy rental increases of around 10%, over the next 12 months.

However, the Canberra office market has soften and will continue that way for a while — mainly because of the traditional slump, following a change of government.

Bottom Line: Apart from Melbourne and Adelaide, researchers BIS Shrapnel see this as only a slowdown. Right now, there is no real over supply; and things should rebound next year.

Speak Your Mind