.

A DETAILED SURVEY on the current state of the CBD Office markets by Jones Lang LaSalle was recently reported in the Australian Financial Review (16 July 2015).

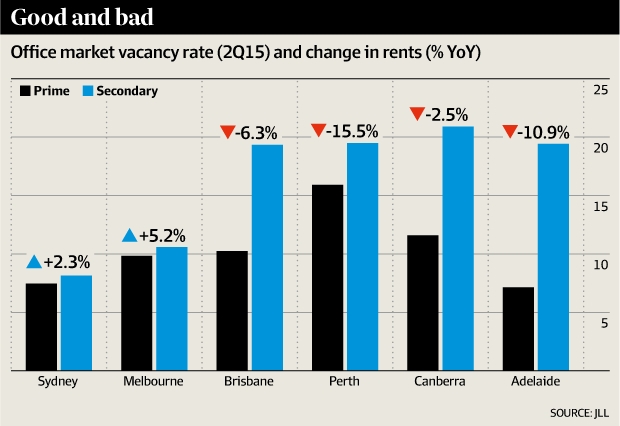

And as you can see from the table below, there are now significant disparities among the CBD Office markets around Australia.

Although Brisbane, Perth and the Canberra each have (total) vacancy rates of 15% or more … there was a healthy 205,000 sqm of space taken up by Business and Government nationally, during the past 12 months.

Rental Movements

Even so, you will notice rentals only rose in Sydney (+2.3%) and Melbourne (+5.2%) — where momentum and confidence have clearly now started to return.

Whereas, the other states have all shown a decline in their office rentals, as space requirements have contracted.

Sydney has been experiencing strong demand for A-grade space — where that vacancy rate has now fallen to 5.2%.

Likewise, Melbourne has seen a solid take-up. Although its vacancy rate rose marginally, to reflect the availability of some backfill space.

Interestingly, there has been strong demand by smaller tenants seeking space under 1000 sqm.

The general consensus is that conditions will continue to improve through 2015-16; and the vacancy rates in the underperforming capital cities will hopefully stabilise.