CONCERN OVER HIGH INFLATION is what is causing the RBA to continue raising interest rates.

So the real question is … will the latest Budget be responsible for adding to inflationary pressures?

Anyway, let’s quickly pick apart the critical issues of the latest Budget – as far as they relate to Commercial property. [Read more…]

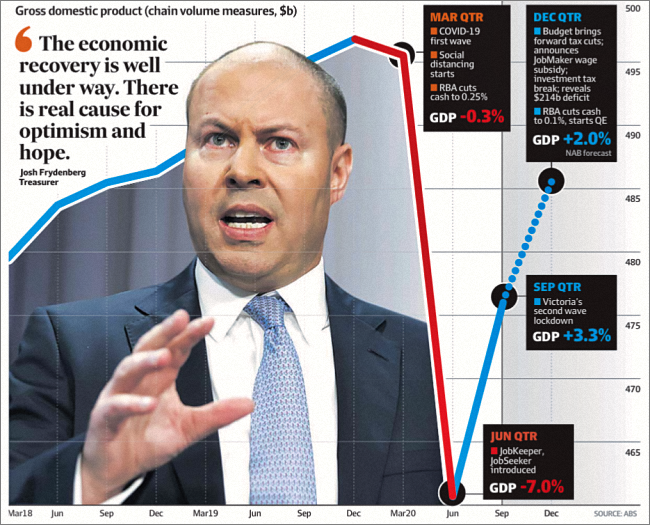

A NUMBER of journalists and economic pundits seem to have been focussing solely upon the latest GDP figures.

A NUMBER of journalists and economic pundits seem to have been focussing solely upon the latest GDP figures.