In fact, the RBA has been cautious … NOT asleep!

Last week, we covered the statistical anomaly relating to Australia’s low unemployment figure. And that may well have influenced the RBA in holding rates steady last month.

Although, the patchy spending in December and January probably coloured their thinking as well.

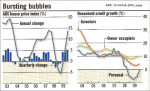

Nonetheless, you continue to see a surge in home values; and headline inflation is now starting to creep up again.

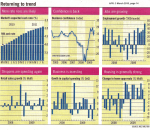

The reality is the major banks effectively helped the RBA out — through increasing their lending rates by more than the RBA’s December 0.25% increase in the cash rate.

This allowed the RBA to keep its powder dry; and simply observe the aftermath of the government pulling back on its handouts.

It has been a balancing act — but you well crawl the league see the RBA increase rates again in May — with a target of 5% by year’s end. However, that will largely depend on whether or not the major banks fall into line along the way.Even economists seemed to hold mixed views as to whether the RBA would leave its cash rate on hold this month; or resume its upward bias.

Despite the housing shortage, this well start to affect the current buoyancy in the residential market. But will probably have little impact on the commercial sector.

Speak Your Mind