ONLINE SHOPPING boomed during the lockdown. However, smaller retail outlets in strip centres and malls are actually struggling.

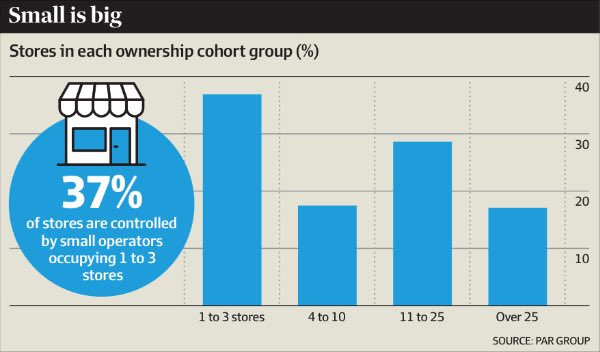

A recent study showed 37% of some 10,000 tenancies are run by small business owners – with just 1 to 3 outlets. And they mostly comprise food, health and beauty.

Those tenants operating 4 to 10 outlets are mainly fashion businesses – accounting for about 18% of tenancies. With chain operators including the likes of Harvey Norman and Flight Centre being among those with over 25 outlets.

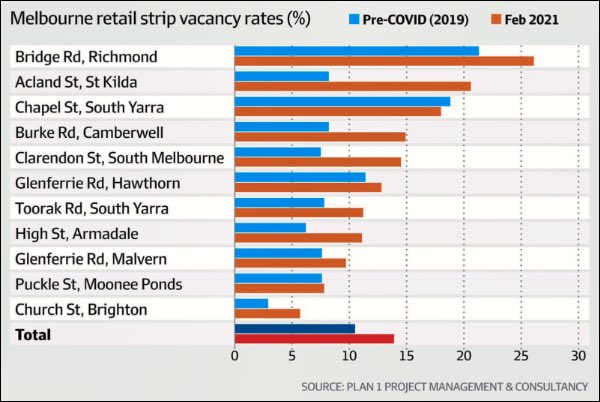

To emphasise the parlous state of the retail market, a recent survey compared vacancy rates around Melbourne – both before and after COVID. And I suspect this is fairly indicative for the whole of Australia.

Bottom Line: Even with the rising vacancy levels, some investors still prefer retail property. This would seem to defy logic – when these investors are prepared to accept net passing yields of 3% to 4% per annum.

The clear inference is they are expecting retail rents to escalate. But given the growing vacancy rate, rental growth would appear unlikely any time soon.

Speak Your Mind