COMMERCIAL BUILDING OWNERS remain unaware of the taxation benefits their property can generate. One of the most beneficial, yet often missed, deductions is building depreciation.

What is Building Depreciation?

As a building gets older and items within it age, they depreciate in value. The Australian Taxation Office (ATO) recognises this and allows property investors to claim deductions relating to the wear and tear on buildings and the fixtures and fittings within.

Claiming depreciation is your key to increasing cash flow on commercial properties.

Building write-off can be claimed on the structure of a commercial building so long as construction commenced after the 20th of July 1982. In cases where construction commenced before this date, depreciation can still be claimed on fixtures and fittings.

The tenants of a commercial property are able to claim depreciation on any fit-out they add to a property from the starting date of their lease. This includes assets such as desks, shelving, fire-fighting equipment, security systems and carpet.

Commercial building owners may also be able to claim depreciation on any assets installed and left behind by previous tenants once their tenancy has ceased.

Is Your Property Too Old?

Many commercial property owners assume they are unable to claim depreciation on their property, or receive significant deductions — because it is too old.

However, there are still significant depreciation deductions available on the fixtures, fittings, plant and equipment contained within the property.

Some examples of these assets include carpets, air conditioning, blinds, hot water systems, light fittings, lifts, partitioning and bathroom accessories.

The Rules in Action

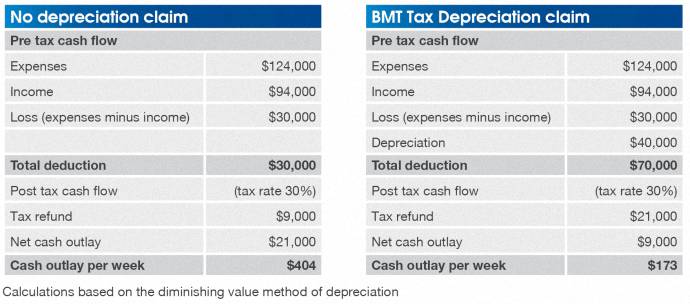

The following case study shows how depreciation can increase the cash flow of a typical commercial property.

Damien owns a commercial office building, which was purchased for $1.1 million.?He leases it to a tenant for $1,800 per week (totalling approximately $94,000 per year).

His expenses (including interest, rates and management fees) total approximately $124,000 per year.

Damien engaged BMT Tax Depreciation to prepare a tax depreciation schedule, the first year showed a $40,000 deduction.

The below table shows how Damien’s holding costs changed, without depreciation on the left and with depreciation maximised on the right.

This example illustrates the benefits of depreciation. Damien has improved the cash flow of this property by $231 per week by simply claiming property depreciation.

Who Should You Talk To?

It is recommended that commercial building owners contact a Quantity Surveyor to complete a depreciation schedule.

Quantity Surveyors are one of the few professionals recognised to have appropriate construction costing skills to calculate the cost of items for the purposes of depreciation.

They are qualified by the ATO under Tax Ruling 97/25 and can ensure both building owners and tenants are able to claim the maximum depreciation deductions.

BOTTOM LINE: Ensuring commercial property owners and tenants do not miss out on valuable depreciation deductions can be a very complicated and intricate process. That is why a good idea to contact a specialist Quantity Surveyor.

Speak Your Mind