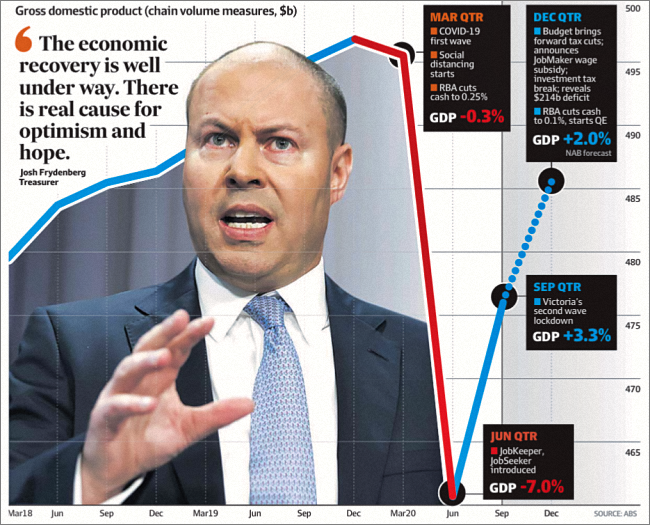

THE 2020-21 FEDERAL BUDGET introduced a number of new, temporary measures. The focus is to help boost the Australian economy out of this pandemic-induced recession, drive investment and to create more jobs.

This budget announced record-breaking incentives that are now available for businesses located Australia wide. [Read more…]